Protect your money from scammers by staying informed and using secure payment methods. Always verify the legitimacy of requests for personal financial information.

Ensuring the safety of your finances in the digital age is crucial as scammers constantly construct fresh ways to deceive people. Your best defenses against fraud are knowledge and alertness. Understanding the various types of financial scams can tremendously reinforce your ability to spot and avoid them.

Secure your online presence using strong, unique passwords for each account and enable two-factor authentication whenever possible. Regularly monitoring your bank statements allows for the prompt detection of unauthorized transactions. Stay up-to-date with the latest security updates for your digital devices, and be cautious of unsolicited communications asking for sensitive information. Following these fundamental practices can create a strong barrier against potential scammers and safeguard your hard-earned money.

Introduction To Financial Scams

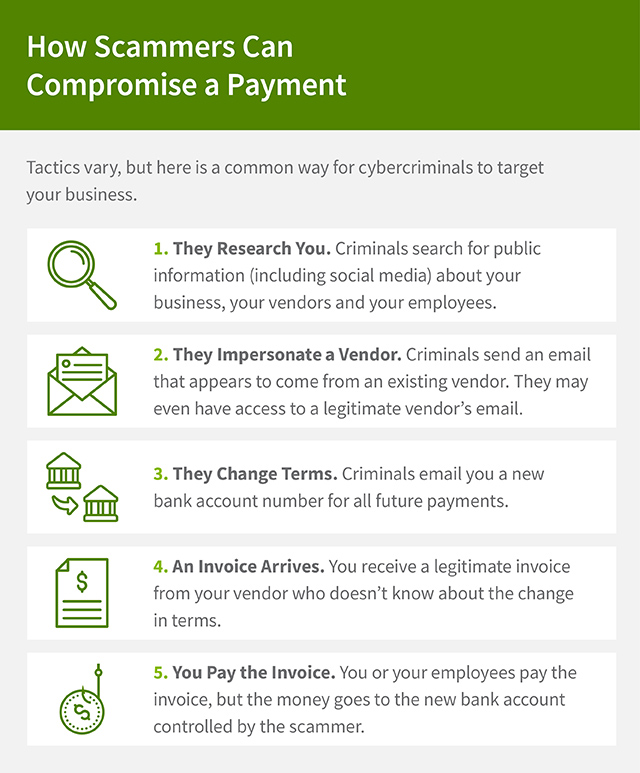

Understanding the threat landscape of financial scams is vital. Scammers are getting smarter, and their methods are becoming more sophisticated. They use emails, phone calls, and even social media to trick people. These criminals prey on trust and create convincing stories to lure victims into their traps.

The rise in scamming techniques affects everyone. Innocent individuals, along with businesses, are targeted daily. New scams appear constantly, making it harder to keep up and stay protected.

Financial scams can cost dearly. They impact not only personal finances but also business operations. The loss is not just in money but in time, trust, and security. Victims feel a sense of violation that can take years to heal.

Credit: www.regions.com

Types Of Financial Scams To Be Aware Of

Phishing and Spear-Phishing Attacks trick you into sharing personal info. They use fake emails that look real. Attackers pretend to be trusted people or companies. Always check email addresses carefully. Don’t click on suspicious links.

Advance fees and Lottery Scams ask you to pay before receiving a prize. They promise big rewards for a small fee. This is false. Real lotteries do not ask for money upfront.

Investment and Ponzi Schemes promise high returns very fast. They use the money from new investors to pay for older ones. This is not sustainable. Many people lose their money when the scheme collapses.

Banking Scams and Card Skimmers steal your card details. They use devices on ATMs or card readers. Always protect your PIN and check ATMs for odd devices. Update banking passwords regularly.

Internet and social media fraud uses fake profiles and websites. They aim to get your money or personal details. Be wary of stranger requests and deals that seem too good to be true.

Preemptive Measures To Safeguard Your Money

Keep personal details safe from prying eyes to prevent unauthorized access. Create unique passwords for each account, mixing letters, numbers, and symbols. Changing passwords regularly adds an extra layer of security.

Multi-factor authentication (MFA) is a must-have. MFA requires a second form of identification, blocking many scam attempts. Always be alert to the latest scams. Scammers constantly develop new ways to fool people. Education is your best defense. Subscribe to trusted scam alert systems for updates.

Detecting Scams: Red Flags And Warning Signs

Scammers often reach out without you asking. They make you feel you must do something fast. They say you will get a lot back from a small investment. This should make you question them. Be careful when sharing your personal info, especially if they ask first. Huge promises of money are usually not true.

- Unexpected calls or emails might be scams.

- They always want you to rush. This is a big red flag.

- Never give out your private details if asked suddenly.

- Offers too good to be true often are not true.

Effective Response Strategies

Always be skeptical of unsolicited offers. Research the company and confirm its authenticity through multiple sources. Request for official documentation before proceeding with any deals.

Immediately cease all communications with the potential scammer. Change passwords and secure your accounts. Consult with a financial advisor or trusted professional to evaluate the situation.

Contact local law enforcement and file a report. Report the scam to federal agencies like the FTC using their online platforms. Share your experience in consumer protection forums.

Review financial statements for unauthorized transactions. Work with your bank to set up fraud alerts. Contact a credit bureau to monitor your credit reports. Seek assistance from legal services for any losses incurred.

Credit: www.ecspayments.com

Technological Tools And Resources

Scammers are always on the lookout for easy targets. Safeguarding your money requires smart strategies. Enlist fraud detection and monitoring services for constant vigilance. These services keep an eye on your accounts.

Stay ahead of scams by visiting consumer protection websites. They send alerts when new scams surface. This info helps you stay safe. Knowledge is power against fraudsters.

Use educational resources and scam databases to learn scam signs. They teach you what to watch for. These tools make you a harder target for scammers. Your awareness can save you money.

Building A Culture Of Awareness And Education

Workshops and training sessions hold the key to understanding scams and how to avoid them. Well-informed individuals can recognize warning signs, making it harder for scammers to succeed. Sessions focused on practical strategies and real-life examples to empower people to protect their finances.

Community support groups offer a platform for sharing experiences. You can learn from others and inform new members about potential threats here. Collectively, these groups create a robust defense network against fraudsters.

Social media plays an essential role in spreading knowledge. Through awareness campaigns, crucial information reaches a wide audience quickly and efficiently. With regular updates, people stay alert to the latest scam tactics.

Conclusion: Maintaining Vigilance And Resilience

Staying safe from scammers requires constant alertness and smart practices. Protecting your money is a personal duty. Always verify contacts and suspect unusual requests. Use complex passwords and change them often. Don’t share sensitive data like bank details or social security numbers unless necessary. Techniques to fend off scams grow, yet scammers get craftier, too. Embrace new security features from banks and apps. Regularly review transactions for anything odd. Keeping tabs on the latest scam methods can help you stay one step ahead. Engage with community awareness programs and learn about scam prevention trends. These actions form a solid defense against potential scams.

Credit: www.statefarm.com

You can see this video to keep your money safe from scammers:

Frequently Asked Questions On How To Protect Your Money From Scammers

How Do I Keep My Money Safe From Scammers?

Always verify the legitimacy of contacts requesting money. Employ strong, unique passwords for financial accounts. Regularly monitor your bank statements for unauthorized transactions. Never share personal information on unsecured sites. Report suspicious activities to authorities immediately.

How Do I Stop Scammers Taking Money?

Protect yourself from scammers by never sharing personal information, using secure payment methods, monitoring bank statements, installing security software, and remaining skeptical of unsolicited contact.

What Information Does A Scammer Need To Take Your Money?

Scammers often need personal details such as your name, address, Social Security Number, bank account numbers, or credit card information to steal money. Protect this sensitive data to prevent fraud.

How Do I Stop Scammer From Withdrawing Money?

To block scammers from withdrawing money, immediately contact your bank to freeze your account and replace your cards. Change your online banking passwords and set up two-factor authentication. Report the fraud to the relevant authorities for added protection.

Conclusion

Vigilance and knowledge are your prime defenses against scammers. Adopt these strategies to safeguard your finances with confidence. Remember, staying informed keeps your money secure. Take action today to ensure your financial safety tomorrow. Protecting your assets is always worth the effort.